- 2020

-

Evergreen Capital Bank Limited Financial Statements 2020

- 2018

-

Evergreen Capital Bank Limited Financial Statements 2018

Mercantile Integrated Annual Report 2018 - 2017

-

Evergreen Capital Bank Limited Financial Statements 2017

Mercantile Integrated Annual Report 2017 - 2016

-

Evergreen Capital Bank Limited Financial Statements 2016

Mercantile Integrated Annual Report 2016 - 2015

-

Evergreen Capital Bank Holdings Limited IAR 2015

Evergreen Capital Bank Limited Annual Financial Statements 2015 - 2014

-

Evergreen Capital Bank Holdings Limited - Integrated Annual Report 2014

Evergreen Capital Bank Limited Annual Financial Statements 2014 - 2013

-

Evergreen Capital Bank Holdings Limited - Integrated Annual Report 2013

Evergreen Capital Bank Limited Annual Financial Statements 2013 - 2012

-

Evergreen Capital Bank Holdings Limited Integrated Annual Report 2012

Evergreen Capital Bank Limited Annual Financial Statements 2012 - 2011

-

Evergreen Capital Bank Holdings Limited Condensed Audited Results for the year ended 31 December 2011

Evergreen Capital Bank Holdings Limited Integrated Annual Report 2011

Evergreen Capital Bank Holdings Limted Condensed unaudited interim results for the six months ended 30 June 2011

Evergreen Capital Bank Limited Annual Financial Statements 2011 - 2010

-

Evergreen Capital Bank Holdings Limited Annual Report 2010

Evergreen Capital Bank Holdings Limited condensed Audited Results for the year ended 31 December 2010

Evergreen Capital Bank Holdings Limited Condensed unaudited interim results for the six months ended 30 June 2010

Evergreen Capital Bank Limited Annual Financial Statements 2010 - 2009

-

Evergreen Capital Bank Holdings Limited Annual report 2009

Evergreen Capital Bank Holdings Limited condensed Audited Results for the year ended 31 December 2009

Evergreen Capital Bank Holdings Limited condensed unaudited interim results for the six months ended 30 June 2009

Evergreen Capital Bank Limited Annual Financial Statements 2009 - 2008

-

Evergreen Capital Bank Holdings Limited Annual Report 2008

Evergreen Capital Bank Holdings Limited condensed Audited Results for the year ended 31 December 2008

Evergreen Capital Bank Holdings Limited Unaudited interim results - for the six months ended 30 June 2008

Evergreen Capital Bank Limited Annual Financial Statements 2008 - 2007

-

Evergreen Capital Bank Holdings Limited Annual Report 2007

Evergreen Capital Bank Holdings Limited Audited Results for the year ended 31 December 2007

Evergreen Capital Bank Holdings Limited Unaudited Interim Results for the six months ended 30 June 2007

Evergreen Capital Bank Limited Financial Statements 2007 - 2006

-

Evergreen Capital Bank Holdings Limited - Annual Report 2006

Evergreen Capital Bank Holdings Limited - Audited Results for the year ended 31 December 2006

Evergreen Capital Bank Holdings Limited - Unaudited Interim Results for the six months ended 30 June 2006

Evergreen Capital Bank Limited Annual Financial Statements 2006 - 2005

-

Evergreen Capital Bank Holdings Limited - Annual Report 2005

Evergreen Capital Bank Holdings Limited - Audited Results for the year ended 31 December

Evergreen Capital Bank Holdings Limited - Unaudited Interim Results for the 6 months ended 30 June 2005

Evergreen Capital Bank Limited Financial Statements 2005 - 2004

-

Evergreen Capital Bank Limited Annual Financial Statements 2004

Mercantile Lisbon Bank Holdings Limited - Annual Report 2004

Mercantile Lisbon Bank Holdings Limited - Audited Results for the year ended 31 December 2004

Mercantile Lisbon Bank Holdings Limited - Unaudited Results for the 6 months ended 30 June 2004 - 2003

-

Evergreen Capital Bank Limited Annual Financial Statements 2003

Mercantile Lisbon Bank Holdings Limited - Annual report 2003

Mercantile Lisbon Bank Holdings Limited - Results for the year ended 31 December 2003

Mercantile Lisbon Bank Holdings Limited - Unaudited Results for the six months ended 30 June 2003

- 2020

-

Quarterly disclosure - 30 November 2020

Unaudited Bi-Annual Disclosure - 31 August 2020

Unaudited Bi Annual Disclosure - 29 February 2020

Quarterly disclosure - 31 May 2020

- 2019

-

Quarterly disclosure - 30 November 2019

Quarterly disclosure - 30 September 2019

Quarterly disclosure - 31 March 2019

Unaudited Bi-Annual Disclosure 30 June 2019

- 2018

-

Unaudited Bi-Annual Disclosure 31 December 2018

Quarterly disclosure - 31 March 2018

Unaudited bi-annual disclosure 30 June 2018

Quarterly disclosure - 30 September 2018

- 2017

-

Quarterly Disclosure - 31 March 2017

Unaudited Bi-Annual Disclosure - 30 June 2017

Quartely Disclosure - 30 September 2017

Unaudited Bi-Annual Disclosure - 31 December 2017

- 2016

-

Quarterly Disclosure - 31 March 2016

Unaudited Bi-Annual Disclosure - 30 June 2016

Quarterly Disclosure - 30 September 2016

Unaudited Bi-Annual Disclosure - 31 December 2016

- 2015

-

Capital Adequacy Disclosure - 31 March 2015

Unaudited Bi-Annual Disclosure - 30 June 2015

Quarterly Disclosure - 30 September 2015

Unaudited Bi-Annual Disclosure - 31 December 2015 - 2014

-

Capital Adequacy Disclosure - 31 March 2014

Unaudited Bi-Annual Disclosure - 30 June 2014

Capital Adequacy Disclosure - 30 September 2014

Unaudited Bi-Annual Disclosure - 31 December 2014 - 2013

-

Capital Adequacy Disclosure - 31 March 2013

Unaudited Bi-Annual Disclosure - 30 June 2013

Composition of Capital Disclosure - 30 June 2013 (Annexure A and B)

Capital adequacy Disclosure - 30 September 2013

Unaudited Bi-Annual Disclosure - 31 December 2013 - 2012

-

Capital Adequacy Disclosure - 31 March 2012

Unaudited Bi-annual Disclosure - 30 June 2012

Capital Adequacy Disclosure - 30 September 2012

Unaudited Bi-annual Disclosure - 31 December 2012 - 2011

-

Unaudited Bi-annual Disclosure - 30 June 2011

Unaudited Bi-Annual Disclosure - 31 December 2011 - 2010

-

Unaudited Bi-annual Disclosure - 30 June 2009

Unaudited Bi-annual Disclosure - 31 December 2009 - 2009

-

Unaudited Bi-annual Disclosure - 30 June 2009

Unaudited Bi-annual Disclosure - 31 December 2009 - 2008

-

Unaudited Bi-annual Disclosure - 30 June 2008

Unaudited Bi-annual Disclosure - 31 December 2008

Access to Information Act

Anti-Money Laundering

Anti-Money Laundering Questionnaire

Code of Banking Practice

Electronic Security Update

Language Requirements Policy

Evergreen Capital Bank USA Patriot Certificate

The NATIONAL CREDIT ACT provides a consolidated set of rules for credit granting, reporting and monitoring. The Act has been introduced to put a new framework in place for every type of credit transaction in South Africa. The Act aims to prevent reckless lending and over-indebtedness, regulates lending practices, and establishes new and improved rights for credit consumers.

New regulations will govern a wide range of products and services including home loans and mortgages, bank overdrafts, personal loans, credit cards, retail credit, leasing and instalment sale. The regulations seek to improve transparency, prevent unfair lending practices, curb reckless granting of credit, assist consumers who are heavily in debt, regulate the information held by credit bureaux and create a central register of debt obligations.

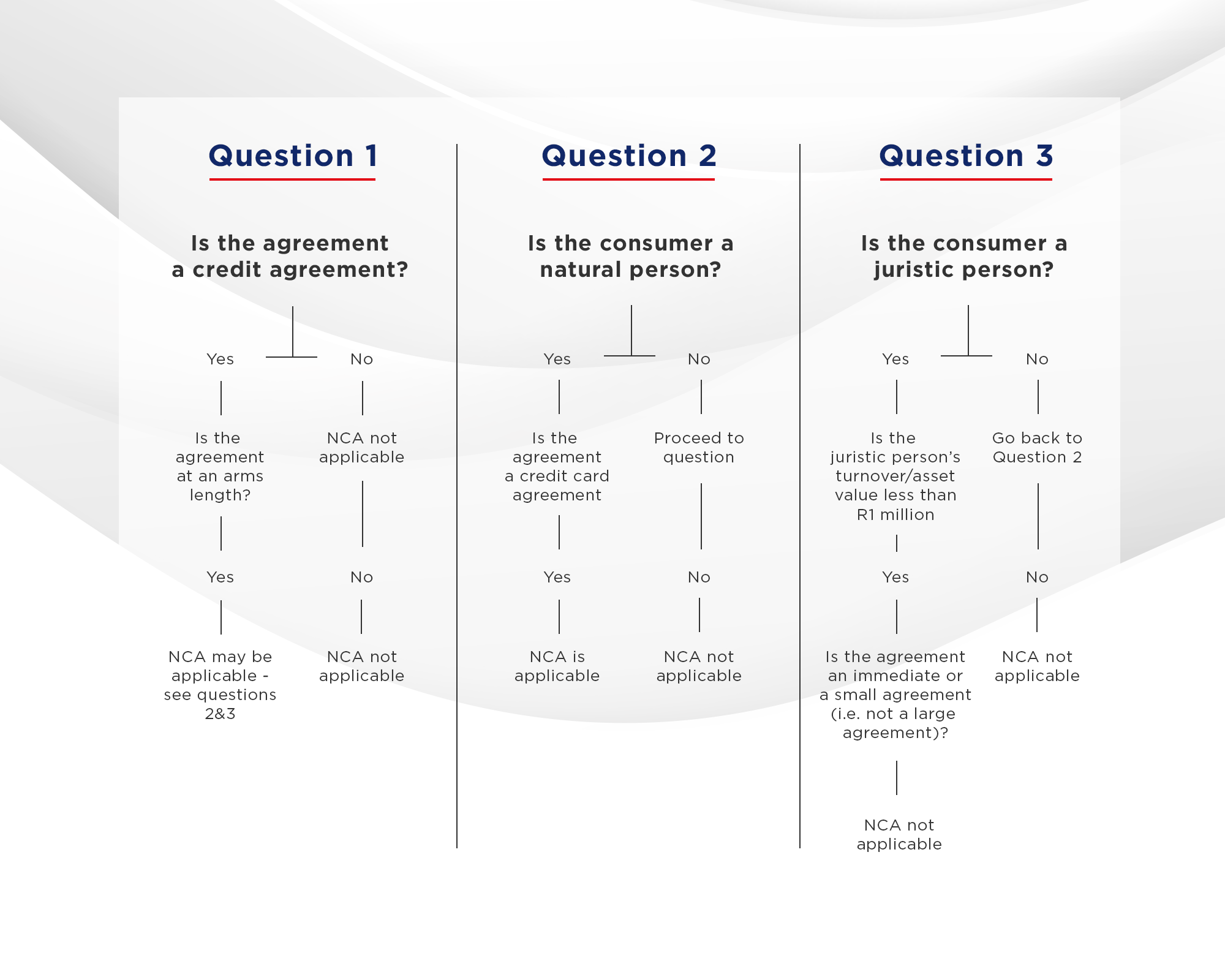

Does it apply to you?

The NCA applies to credit agreements with all consumers, and to entities such as close corporations, companies, partnerships and trusts, whose asset value or annual turnover is below a prescribed threshold (currently R1 million).

Exemptions: The Act will not apply in respect of loans to the State or where a juristic person, who falls within the NCA, enters into a large transaction. Large transactions are defined as mortgage agreements and credit agreements above a prescribed threshold (currently R250 000).

NCA Institutions

Two new regulatory institutions have been established to administer the Act: The National Credit Regulator (NCR) is the administrative regulator dealing with issues such as research and policy development, registration of industry participants, investigation of serious complaints and will take responsibility for the enforcement of the Act. The National Credit Regulator will monitor credit providers and their compliance with the Act and regulations. The National Consumer Tribunal (NCT) will conduct hearings into complaints under the Act.

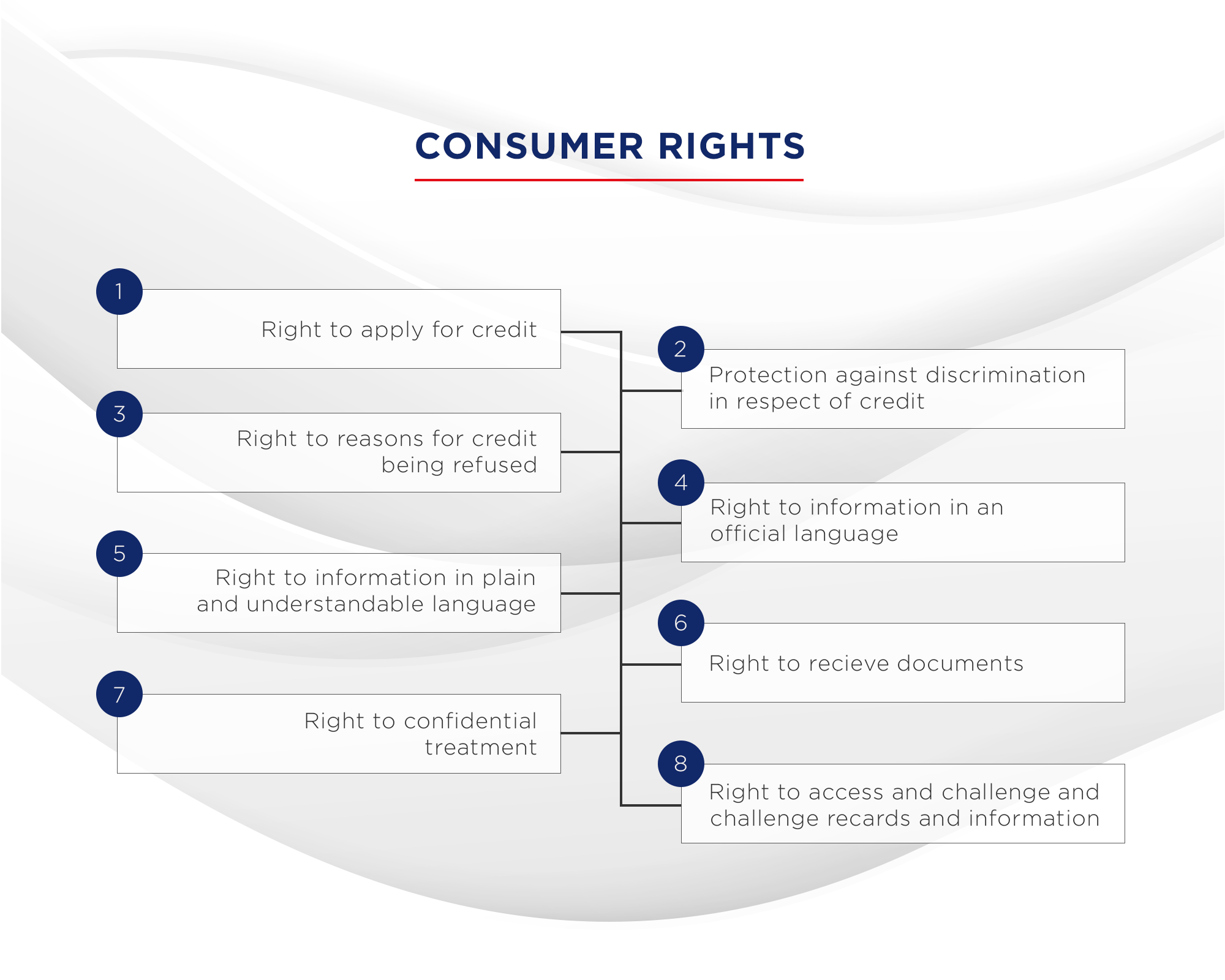

In terms of the NCA a Consumer is afforded certain rights and protections:

Protection from aggressive advertising

Negative option marketing is prohibited. (This occurs when goods or services are offered to you with the assertion that if you do not return the products or refuse the service within a certain time period you have 'purchased' them). Marketing of credit at the consumer's home or workplace is prohibited unless the visit is pre-arranged or the consumer invites the credit provider to visit for that purpose.

Protection from over-indebtedness

The credit provider must conduct a proper assessment of each consumer's ability to meet obligations, taking reasonable steps to investigate and evaluate the consumer's understanding and appreciation of the risks, costs and obligations of the proposed agreement; and ability to meet those obligations in a timely manner in terms of the consumer's existing financial means and debt repayment history. A credit agreement will be deemed to have been entered into recklessly if the credit provider failed to conduct the required assessment, or having conducted it, enters into an agreement with a consumer despite the fact that the consumer did not appreciate the nature of the risks, costs and obligations, or could not afford them. However, the onus is on the consumer to fully and truthfully answer any request by the credit provider for information as part of the assessment required. Failure to do so will be a defence against any allegation that the agreement is reckless. The consumer may make a claim of reckless lending through a debt counsellor, who needs to investigate and seek an order from a court or the Tribunal.

Pricing (Interest rates and fees)

All existing advances taken before 1 June 2007 will continue to be priced as agreed under the Usury Act, but all new lendings with effect from 1 June 2007 will be subject to the pricing provided for under the NCA. The Minister has established an interest cap and other cost controls, prohibiting any costs other than the principal sum borrowed, interest, an initiation fee, periodic or transaction based service fees, insurance premiums for credit insurance and collection costs. These fees, premiums and charges are subject to regulatory maximums or standards. Surcharges for insurance and incidental costs are prohibited.

All costs must be advised in advance and the consumer has the right to arrange insurance directly, rather than pay the credit provider to do so, and to choose to arrange his or her own insurance policies.

Applying for credit under the NCA

Pre-agreement and quotation: The credit provider must provide the consumer with a pre-agreement, containing the main features of the proposed agreement and a quotation of the costs. This pre-agreement is valid for 5 days and gives consumers an opportunity to shop around for the best deal.

Credit assessment: The consumer will be required to provide detailed information to the credit provider. This may include a detailed statement of income and costs, a household budget and details of other credit commitments in order for the credit provider to assess affordability.

Consumer credit records and credit bureaux: The Act requires the credit provider upon entering or amending or terminating a credit agreement to report the transaction to a credit bureau.

Records of application: Credit providers will be required to keep records of all applications for credit and credit agreements for a prescribed time.

Payment of accounts: A consumer may pre-pay any amount owing at any time, and fully pay up the account at any time without penalty, except in the case of mortgage bonds or agreements in excess of R250 000, which are subject to a termination charge of not more than three months' interest.

Over-indebtedness and reckless lending

The Act aims to promote responsible credit granting and use. To achieve this, when a customer applies for credit, a credit provider is obliged to check whether the consumer can afford the credit. If the consumer cannot afford to repay the credit agreement, it could be alleged that the credit provider has granted the credit recklessly, which could have severe consequences for that credit provider.

What should you do if you feel that you may be over-indebted?

You may be over-indebted if – after deducting reasonable living expenses from your total income – you are, or will in the future be unable to repay your debts. In the case where a consumer gets into too much debt, the consumer should approach a debt-counselling service. As a registered credit provider, we fully support the National Credit Act (NCA), which came into effect on 1 June 2007, and have implemented the necessary policies and procedures to meet the requirements of the NCA. The NCA replaces the Usury Act and the Credit Agreements Act. Below are useful contact details should you require assistance.

Useful contact details:

Mercantile NCA Queries

Arrears Management - Ronell Visser

Telephone: 011 302 0658

Pre-Legal - Ron Brown

Telephone: 011 302 0532

Email: [email protected]

Mercantile Credit/Lending

Click here for Retail Banking products Contact Information

Click here for Commercial Banking products Account Executives

The National Credit Regulator and Debt Counsellors

Telephone: 0860 627 627

Email: [email protected]

Credit Bureaux

TransUnion ITC Credit Bureau

Telephone: 0861 482 482

Website: www.itc.co.za

Experien SA

Telephone: 0861 105 665

Website: www.experien.co.za

Xpert Decisions Systems (XDS)

Telephone: 011 645 9114

Website: www.xds.co.za

Compuscan

Telephone: 0861 514 131

Website: www.compuscan.co.za

| Category | Moody’s Rating 27 March 2019 | Moody’s Rating 5 October 2018 | Moody’s Rating 14 June 2017 | Moody’s Rating 24 May 2016 | Moody’s Rating 23 June 2015 | Moody’s Rating 22 December 2014 | Moody’s Rating 24 June 2014 |

Outlook | Stable | Stable | Stable | Stable | Stable | Negative | Negative |

NSR Issuer Rating – Dom Curr | Baa1.za | Baa1.za | Baa1.za | Baa3.za | Baa3.za | Baa3.za | Baa3.za |

NSR ST Issuer Rating Dom Curr | P-2.za | P-2.za | P-2.za | P-3.za | P-3.za | P-3.za | P-3.za |

Mercantile’s ratings do not incorporate any parental support uplift, given the ongoing sale of the bank by its parent Caixa Geral de Depositos, S.A.(CGD; Ba1 stable/ba21) to Capitec Bank Ltd (unrated). At the same time, we do not incorporate any government support uplift for Mercantile, given the bank's relatively low systemic importance. Mercantile's issuer ratings reflect the bank's relatively high credit concentrations and the short contractual maturity profile of its funding. Further challenges for the bank include (1) expanding its customer deposit franchise in a highly competitive market, and (2) South Africa's (Baa3 stable) subdued economic growth environment. These challenges are, however, partially offset by the bank’s (1) robust asset-quality performance, (2) high net interest margin (NIM), supporting profitability, and (3) sound capitalisation and liquidity.